.jpg)

Are you trying to report your cryptocurrency taxes on TaxAct?

In this guide, we’ll cover the basics of cryptocurrency taxation and share a simple step-by-step process that can make filing your crypto taxes on TaxAct easier than ever.

Do I report buying cryptocurrency on my taxes?

Remember, cryptocurrency is considered property by the IRS and is subject to capital gains and income tax.

Capital gains tax: If you dispose of cryptocurrency, you’ll incur a capital gain or loss depending on how the price of your crypto has fluctuated since you originally received it. Examples of disposals include selling cryptocurrency or trading it for other cryptocurrencies.

Income tax: If you earn cryptocurrency, you’ll recognize ordinary income based on the fair market value of your coins at the time you received them. Examples include earning staking, mining, or airdrop rewards.

For more information, check out our complete guide to crypto taxes.

Does TaxAct handle cryptocurrency?

While TaxAct does allow users to file crypto taxes, the platform does have limitations.

Because TaxAct is not a native crypto tax calculator, the platform does not have automatic integrations with prominent exchanges. That means that TaxAct may have trouble determining your cost basis for crypto disposals and calculating your capital gains and losses.

Luckily, TaxAct partners with crypto tax platforms like CoinLedger to make filing cryptocurrency taxes easier than ever.

Why should I use CoinLedger with TaxAct?

If you’re looking for a crypto tax software to use with TaxAct, consider CoinLedger.

User friendly: You don’t need to be a tech or finance expert to use the platform. CoinLedger is easy-to-use and designed for the everyday crypto investor.

Customer support: If you have any questions during any step of the process, our customer support team is ready to answer your questions on email and live chat.

Integrations with wallets and exchanges: CoinLedger can automatically import your transactions from wallets like MetaMask and exchanges like Coinbase!

Interested in getting started? Generate a free preview report today.

How to file your crypto taxes with TaxAct

Once you’ve created a CoinLedger account, you’ll be able to compile all of your crypto gains and losses on a single csv file. Here’s how you can upload this file onto your TaxAct account.

1. Pick your TaxAct plan. You’ll need Premier or higher to report gains and losses from cryptocurrency.

2. Log in to your TaxAct Account. Enter your personal information including your name, marital status, and address.

3. Navigate to the Stock CSV Section

Search "Crypto" from the help center sidebar on the right-hand side of the screen. Select the option labeled ‘Crypto’.

4. In the next screen, select the option labeled ‘CSV Import’.

5. After this, click the purple button labeled ‘CSV Import’ to get started uploading your transactions.

6. Click ‘Choose File’ and select the TaxAct CSV file that you downloaded from CoinLedger.

This is the file that contains all of your gains and losses from all of your cryptocurrency transactions. Then, click ‘Continue’.

If you don’t have a file for this step, you can create an account with CoinLedger and generate a TaxAct csv file in minutes.

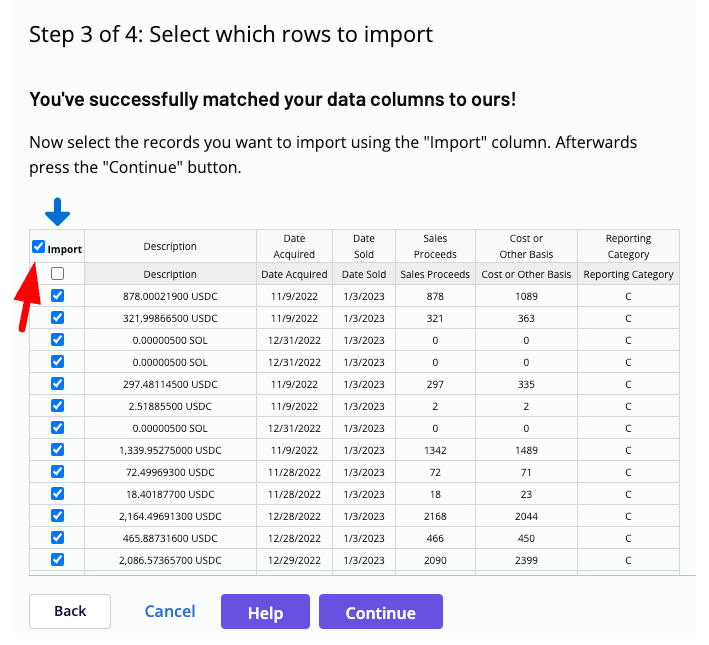

7. You will see a preview of the file you just imported. CoinLedger automatically matches your data to TaxAct’s format, so you can simply hit ‘Continue’.

8. Select all rows by clicking the top checkbox. This will select all rows. Click ‘Continue’.

You may receive an alert from TaxAct to double check the file. Once you’ve confirmed the information is correct, you can click ‘Continue’.

9. Review your data, then click the “Import” button to import your data into TaxAct.

10. That’s it! Once you’ve successfully imported your TaxAct transactions, you’ll see this message. You can now complete the rest of your tax return within TaxAct.

Frequently asked questions

- When do you report cryptocurrency on your tax return?

Typically, you report cryptocurrency on your tax return when you’ve disposed of it or earned crypto income. Holding cryptocurrency is not considered a taxable event.

- What tax rate do you pay on cryptocurrency?

The tax rate that you pay on cryptocurrency is dependent on multiple factors, such as the length of time you’ve held your crypto and your personal income bracket.

- Where do I enter crypto on TaxAct?

Cryptocurrency gains and losses should be entered in the ‘Investment Income’ section of your TaxAct account.

- How can I create a csv of my crypto transactions for TaxAct?

With CoinLedger, you can create a csv that contains all of your cryptocurrency gains and losses and can easily be imported into TaxAct.

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)