.jpg)

Key takeaways

- NFTs are subject to capital gains tax and income tax.

- When you buy an NFT with cryptocurrency, you’ll incur a capital gain or loss depending on how the price of your crypto has changed since you acquired it.

- When you sell/trade away an NFT, you’ll incur a capital gain or loss depending on how the price of your NFT has changed since you acquired it.

How much do you pay in taxes when you sell an NFT?

Unfortunately, there isn’t a simple answer to that question. The tax rate that you pay can vary depending on multiple factors such as how long you held your NFT and how the price of your NFT has changed since you originally received it.

We know that trying to navigate all of this can be complicated. So in this guide, we’ll break down everything you need to know about NFT taxes as a buyer, a seller, or a creator. We’ll also walk through four simple strategies that can help you reduce your NFT tax liability.

What is an NFT?

NFT stands for non-fungible token. It’s a fancy term for a unique digital asset that’s verified by blockchain technology.

An NFT may be a JPEG, an MP4, or even a GIF. Each NFT comes with unique IDs and a verified transaction history that shows who minted it, who created it, and who has previously owned it.

In 2021, NFTs started coming into prominence as both a way for creators to get fair compensation for their work and an exciting new type of investment asset. In March of that year, an NFT artwork by the artist Beeple sold for a stunning $69 million.

What guidance has the IRS given on NFTs?

In 2022, the IRS released a draft stating that NFTs would be taxed as ‘digital assets’, meaning that they’re taxed similarly to cryptocurrencies. However, the IRS has not yet explicitly stated whether NFTs will be taxed as collectibles (more on this later)!

Do I have to report NFTs on my tax return?

In 2022, the IRS released a draft stating that NFTs would be considered ‘digital assets’, similar to cryptocurrencies. If you sold, received, or gifted any NFTs during the tax year, you’ll be required to check ‘Yes’ on the ‘crypto tax question’ on Form 1040.

In addition, NFTs are subject to capital gains and ordinary income tax.

How are NFTs taxed?

Just like traditional cryptocurrencies like Ethereum and Bitcoin, NFTs are subject to capital gains and income tax.

What NFT transactions are taxable?

The following transactions are subject to capital gains tax depending on how the price of your crypto-assets has changed since you originally received them.

Buying an NFT with cryptocurrency

.jpg)

Selling an NFT for fiat or cryptocurrency

%20(1).jpg)

Trading an NFT for another NFT

%20(1).jpg)

Meanwhile, income earned from primary or secondary NFT sales as a creator is considered ordinary income and taxed accordingly.

.jpg)

What NFT transactions are non-taxable?

The following NFT transactions are considered non-taxable.

- Buying an NFT with fiat currency

- Transferring NFTs between different wallets

- Donating an NFT

How much are NFTs taxed?

The tax rate you pay on your NFT transactions can vary depending on your specific situation. Let’s run through a few common scenarios.

Short-term capital gains rate

If you sell an NFT within 12 months of receiving it, you’ll be subject to the short-term capital gains tax rate — whether your NFT is a collectible or not (more on this in the following sections).

The short term tax rate can be anywhere from 10 - 37% of your gains, depending on your personal income tax bracket.

Income tax rate

As mentioned earlier, revenue from NFT sales is taxed as ordinary income for creators. Like short-term capital gains, ordinary income is taxed from 10 - 37% at the federal level.

Does the collectible tax rate apply to NFTs?

It’s possible that the IRS will treat certain NFTs as collectibles for tax purposes.

Collectibles are a special class of capital asset subject to a higher tax rate. If your NFT is considered a “collectible”, you will need to pay a maximum tax of 28%, which is higher than the typical long-term capital gains tax rate. The collectible tax rate is only applicable on long-term sales of assets, so it does not apply to anything disposed of after less than 12 months of holding.

The IRS has stated that it will use a ‘look-through’ approach to determine whether an NFT constitutes a collectible. This means that the IRS will look at what the NFT actually represents (i.e., its rights and benefits), to determine its characterization as a collectible or not.

The IRS defines a collectible as:

- Any work of art,

- Any rug or antique,

- Any metal or gem,

- Any stamp or coin,

- Any alcoholic beverage, or

- Any other tangible personal property that the IRS determines is a "collectible" under IRC Section 408(m).

It's possible that "trading card-like" NFTs, such as those on the NBA Top Shot platform, will also be treated as collectibles. Physical trading cards have historically been treated the same way.

At this time, it’s unclear whether ‘profile picture’ NFTs will be considered collectibles. The conservative approach is to treat them as such and pay the collectible tax rate on long-term sales.

If you’re not sure what category your NFT falls into, you should reach out to a tax professional with details about your specific situation.

Long-term capital gains rate

If your NFTs are not considered collectibles, they’ll be subject to typical long-term capital gains tax rates if disposed of after 12 months or more of holding.

Long-term capital gains are taxed anywhere from 0 to 20%, depending on your income level.

How to report your NFT taxes

Gains and losses from your capital assets (including your NFTs) must be reported on IRS Form 8949 and included with Schedule D.

If the NFTs you are trading are considered to be collectibles, it's recommended that you report all of your collectibles disposals on a separate 8949 from your other capital assets. Add each collectible disposal to 8949 and sum up your total short-term and long-term collectibles trading gains/losses for the year.

Since collectibles are subject to a different tax rate than the rest of your capital assets, filling out a separate 8949 can make it easier for you to accurately report capital gains and losses.

After you've calculated the total gains (or losses) of your long-term collectibles trading, use the sum to complete the 28% Rate Gain Worksheet. You will ultimately report these calculations on your Schedule D along with your short-term disposal calculations.

How can I reduce my NFT taxes?

Wondering how you can reduce your NFT tax liability? Here are 4 strategies that can help.

Hold your NFTs for the long-term

The simplest way to reduce your NFT taxes is to simply hold your NFTs for longer than 12 months. As discussed earlier, the long-term capital gains rate is lower than the short-term capital gains rate.

Dispose of your NFTs in a low-income year

Your tax bracket is determined by your ordinary income in a given year. As a result, many investors choose to dispose of NFTs and cryptocurrencies in years where their annual income is low to minimize their tax liability.

Buy with fiat currency instead of appreciated cryptocurrency

Remember, you incur capital gains based on how much the price of your coins has changed since you originally received them. As a result, investors who’ve held Ethereum for multiple years and seen significant appreciation will likely incur a large tax liability if they use their coins to buy an NFT.

Some NFT marketplaces offer the ability for investors to buy NFTs with fiat currency. This can be advantageous from a tax perspective. Because making purchases with fiat is not considered a disposal of property, investors who choose this method do not incur capital gains.

Tax-loss harvesting with NFTs

If you sell your NFTs at a loss, you can claim a capital loss on your tax return. NFT capital losses can offset capital gains from other property disposals (such as profits from NFT, crypto, and stock sales) and up to $3,000 of income.

Can’t find a buyer for your NFT? You can use CoinLedger’s free Tax Loss Harvestooor — a tool that buys your NFT for a small amount of ETH so that you can claim a capital loss on your tax return!

For more information, check out our ultimate guide to tax-loss harvesting.

How are NFT gas fees taxed?

Gas fees paid to acquire or dispose of an NFT can be added to your cost basis and/or gross proceeds and potentially reduce your tax liability in a disposal event.

Gas fees related to acquiring an NFT can be added to your cost basis.

%20(1).jpg)

Gas related to selling or disposing of your NFT can be added to your gross proceeds.

%20(1).jpg)

How are NFTs in play-to-earn games taxed?

Cryptocurrency games allow players to own and trade in-game assets in the form of NFTs. For example, the popular game Axie Infinity allows players to purchase, breed, trade and battle with NFT avatars known as Axies.

It’s likely that most transactions involving in-game NFTs will be subject to the same rules as other NFTs. Buying an NFT with cryptocurrency and selling an NFT within a game like Axie Infinity will likely be considered disposal events subject to capital gains tax.

For more information, check out our guide on how cryptocurrency games are taxed.

How are NFT airdrops taxed?

I received tokens in an airdrop. How is this taxed?

In 2022, Bored Ape Yacht Club airdropped ApeCoin tokens to holders. In cases like these, recipients recognize ordinary income based on the fair market value of their tokens at the time of the airdrop.

For more information, check out our complete guide to airdrop taxes.

I received an NFT in an airdrop

Receiving an NFT in an airdrop should also be considered ordinary income at the time of receipt. In cases like these, you can estimate your income by looking at the fair market value of NFTs with similar characteristics at the time of the airdrop.

Do you pay sales tax when you buy NFTs?

Some states like Washington and Pennsylvania have added NFTs to their list of digital products subject to the sales tax.

It’s important to remember that the responsibility for withholding sales tax falls on those who create and sell NFTs as a business — not on the individuals who buy, sell, and trade NFTs.

In the past, the Supreme Court has ruled that businesses who conduct more than 200 transactions or make $100,000 in sales in a given state are subject to sales tax. It’s reasonable to assume these same rules will apply to NFT creators who meet the same threshold in states where NFT sales tax has been introduced.

However, it’s difficult for NFT creators to abide by these rules. At this time, NFT marketplaces like OpenSea and Rarible don’t collect addresses from users. As a result, trying to determine the states of residence for buyers can be almost impossible.

If you’re a creator who’s met the threshold for sales tax on NFTs, you should reach out to your tax professional on how to stay compliant with state rules and regulations.

How to report your NFT taxes internationally

In most countries, NFTs are taxed similarly to crypto-assets. That means NFTs are typically subject to capital gains and income tax across the world.

If you’re interested in learning more about how NFTs and digital guides are taxed internationally, check out our guides below!

- NFT Taxes Canada

- NFT Taxes Australia

- Crypto Tax Guide UK

- Crypto Tax Guide Australia

- Crypto Tax Guide Canada

How to calculate taxes on your NFT transactions in minutes

If you have multiple NFT transactions in a tax year, calculating your tax bill can be difficult. Luckily, there’s an easier way.

With CoinLedger’s NFT tax software, you can calculate taxes on your cryptocurrency and NFT transactions in minutes.

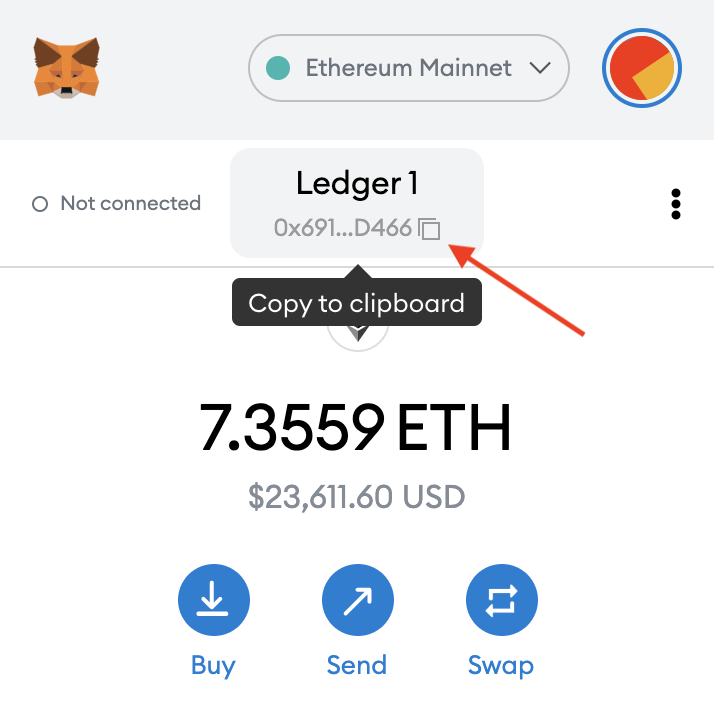

1. Find the public wallet address for your Ethereum wallet.

2. Copy and paste your Ethereum wallet address into CoinLedger. Your complete transaction history will be pulled directly from the blockchain, including any NFT transactions you may have.

3. You’ll be able to view all of your NFT transactions, as well as any NFTs that you currently hold, on your CoinLedger dashboard.

And that’s it! Once you import your transaction history from other wallets and exchanges, you’ll be able to generate a complete tax report with the click of a button.

Looking for an easy way to track your NFT taxes?

Trying to report your NFT taxes manually can be difficult. With crypto tax software like CoinLedger, the process has never been simpler. The platform integrates with the Ethereum blockchain and NFT marketplaces like OpenSea so you can file your taxes in minutes.

Get started with a free account today.

Frequently asked questions

Let’s summarize what we’ve discussed so far by answering a few commonly asked questions about NFT taxes.

Are NFTs taxable?

Yes. Like other crypto-assets, NFTs are considered property and can be subject to both capital gains and income tax.

Is buying NFTs with crypto taxable?

Buying an NFT with cryptocurrency is considered a taxable disposal of your crypto.

How are NFT sales taxed?

When you sell an NFT, you incur a capital gain or loss depending on how the price of your NFT has changed since you originally received it.

Do I have to report NFTs on my tax return?

Yes. NFT disposals should be reported on Form 8949 of your tax return.

Are NFT losses tax deductible?

Capital losses from NFTs can offset capital gains and reduce your tax liability for the year.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

- Treatment of certain nonfungible tokens as collectibles (2023) https://www.irs.gov/pub/irs-drop/n-23-27.pdf

- Tax consequences of nonfungible tokens (NFTs) (2021) https://www.journalofaccountancy.com/news/2021/jun/tax-consequences-of-nfts-nonfungible-tokens.html

- The Taxation of Nonfungible Token Transactions (2021) https://www.cpajournal.com/2021/08/13/the-taxation-of-nonfungible-token-transactions/

- How taxes on cryptocurrencies and digital assets will soon take shape (2022) https://www.ey.com/en_us/tax/how-taxes-on-cryptocurrencies-and-digital-assets-will-soon-take-shape

.png)