Written by:

Miles Brooks

In this guide, we’ll break down everything you need to know about how cryptocurrency is taxed in Australia. We’ll break down the fundamentals of how cryptocurrency is taxed, how the ATO can track your transactions, and a few simple strategies to help you legally reduce your tax bill!

The basics of cryptocurrency taxation and how much you’ll be paying in tax.

Yes. The ATO considers cryptocurrency a form of property that is subject to both capital gains and income tax.

Capital gains tax occurs when you dispose of your cryptocurrency. This happens when you sell it, trade it for another cryptocurrency, gift it, or use it for a purchase.

Your capital gain is simply the difference between the AUD value of the cryptocurrency at the time you disposed of it minus the AUD value of the cryptocurrency at the time it was acquired.

It’s important to remember that relevant exchange fees and blockchain network fees can be added to your cost base or subtracted from your gross proceeds. This can reduce your capital gains tax in a disposal event.

Income taxes apply for cryptocurrencies that you have earned — whether that is through a job, mining, staking, or other means. Your income is determined based on the fair market value of your cryptocurrency at the time of receipt.

The ATO introduced a data-matching program in 2019 — which allows the agency to access data from cryptocurrency designated service providers like Binance and CoinJar. As a result, it’s likely that the ATO already has information about your cryptocurrency capital gains and income.

The ATO’s assistant commissioner has been quoted saying, “There isn’t a game of hide and seek. We have got that information and all we are asking people to do is follow the rules.”

In 2023, the ATO sent thousands of warning letters to crypto investors. If you received one of these letters, you should make sure to accurately report your capital gains and income from the current as well as prior tax years.

It’s important to note that in the past, the ATO has sent warning letters as a blanket notice to crypto investors. It’s possible that you may not have any cryptocurrency tax liabilities — however, you should double-check your transactions to make sure this is the case.

The amount of tax you’ll pay on your cryptocurrency income is dependent on your income levels during the current tax year. Here’s a breakdown by income level.

In addition, investors who have held their cryptocurrency for more than 12 months can apply a long-term capital gains discount of 50%.

For more information, check out our guide to Australian crypto tax rates.

Not every cryptocurrency transaction is subject to tax. Here are a few examples of tax-free transactions in Australia.

Here are a few strategies that can help you reduce your cryptocurrency taxes.

It’s important to remember that your cryptocurrency will be taxed differently based on whether you are considered to be an investor or a trader.

Here’s a breakdown of the differences between investors and traders as per the ATO’s guidelines.

Investor: Investors typically buy cryptocurrencies for the long-term and are primarily interested in building up their wealth over time. Most retail crypto investors would likely fall into this category.

Trader: If you’re mining or trading cryptocurrency in what the ATO describes as an “organized, business-like manner”, you may be considered a trader. Here are a few signs that you may fall into this category:

Of course, the lines between what constitutes a “trader” and an “investor” can get fuzzy at times. If you’re not sure which category you fall under, you should consult a tax professional.

While traders and investors are both subject to tax requirements, there are some differences in how the two groups are taxed.

Traders are not eligible for the 50% long-term capital gains discount. However, any relevant costs can be deducted as expenses.

Investors are eligible for the 50% long-term capital gains discount, but cannot deduct relevant expenses.

In certain scenarios, it is possible to be both a trader and an investor. For example, a businessperson that owns a crypto mining business but also has personal crypto investments would most likely fall into this category.

If you are both an investor and a trader, you will need to report all your transactions as an investor and all your transactions as a trader separately. This means that it's important to keep your trading and investing wallets separate to prevent confusion when it’s time to lodge your tax return.

To calculate your capital gains, you can use the following formula.

Capital Gain/Loss = Proceeds - Cost Base

In this case, your cost base is how much it cost you to acquire your cryptocurrency. This should be the fair market value of your crypto at the time of receipt plus any relevant fees.

Meanwhile, your proceeds are how much you earned when disposing of your cryptocurrency. This should be the fair market value of your crypto at the time of receipt minus any relevant fees.

Calculating your crypto gains and losses can be tricky if you’ve made several purchases at different times. Consider the question below:

The answer is dependent on what accounting method James chooses to use: FIFO (first-in, first-out), LIFO (last-in first-out), or HIFO (highest-in, first-out). Each one of these methods present different benefits. For more information, check out our guide to FIFO, LIFO, and HIFO.

What method you’re allowed to use depends on whether you’re classified as an investor or a trader. If you’re an investor, all three of these methods are allowed as long as you’re able to individually identify your cryptocurrency assets. However, traders can only use FIFO.

You can read the ATO’s guidance on this issue here.

If you’re lodging your taxes for the financial year of July 1, 2022 – June 30, 2023 by yourself, it needs to be submitted by October 31, 2023.

Australians who lodge their tax return with an accountant have slightly more time. This deadline varies depending on your specific circumstances but can be as late as May 15, 2024. However, you’ll need to be registered as a client with an accountant by October 31 to qualify for the extended deadline.

Not paying your taxes on time can be expensive. The ATO may apply a “failure to lodge on time” (FLT) penalty. The longer it takes for you to lodge your tax return past the deadline, the higher this tax penalty will become.

Here’s a breakdown of how large this penalty can grow:

If you have a circumstance that caused you to file your taxes after the deadline, you can make a request to remit the penalty. According to the ATO, taxpayers with a history of complying with tax law are treated more leniently.

How transactions like mining, staking, and airdrops are taxed.

Buying cryptocurrency with fiat currency is considered a non-taxable event.

However, you should keep careful records of your cryptocurrency purchases so you can easily calculate your capital gains and losses in the case of a future disposal.

Transferring your cryptocurrency to another wallet that you own is not considered a taxable event. However, you will need to pay taxes on any fees you paid to transfer your cryptocurrency. Spending cryptocurrency on transfer fees is considered a disposal subject to capital gains tax.

You should keep a record of your wallet-to-wallet transfers so that you’ll be able to calculate your taxes in the case of a future disposal.

Converting your cryptocurrency to fiat currency like AUD is considered a taxable disposal. You will incur a capital gain or loss based on how the price of your asset has changed since you originally received it.

Trading one cryptocurrency for another is considered a taxable disposal. You will incur a capital gain or loss based on how the price of the coins you are trading away has changed since you originally received them.

Cryptocurrency losses can help you save money on your tax bill.

If you have recorded a loss on a cryptocurrency sale, you can claim this as a capital loss. Capital losses come with tax benefits — losses can offset any gains you have during the year. If you end up with a net capital loss for the year, you can roll this over to the next year to offset future capital gains.

Some investors intentionally choose to sell their cryptocurrency at a loss during the tax year to claim the tax benefits. This is a strategy known as tax-loss selling.

It’s important to note that you cannot sell cryptocurrency, claim the tax benefit, and buy back the same asset immediately. The ATO will likely disallow this transaction as a ‘wash sale’.

If you’re receiving cryptocurrency as payment for your work, you will recognize ordinary income based on the fair market value of your crypto on the date you received it.

If you dispose of your crypto in the future, you will incur a capital gain or loss depending on how its price has changed since you originally received it.

The tax treatment of cryptocurrency mining varies depending on whether you are mining as a hobby or as a business.

If you are mining cryptocurrency as a hobby, your mined coins are considered a new asset with a cost base of $0. When you dispose of it, you incur a capital gains tax event.

You’ll fall into this category if you are mining cryptocurrency as a pastime and are not seeking to make profits.

If you are mining cryptocurrencies as a business, you recognize income equal to the fair market value in AUD of the cryptocurrencies at the time you receive them.

If you are running a large-scale mining operation, it will likely be considered a business by the ATO.

The ATO has stated that cryptocurrency earned from staking and other forms of earned interest on your cryptocurrency is subject to income tax based on its fair market value at the time of receipt.

If you dispose of your staking and interest rewards in the future, you’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

Like cryptocurrencies, NFTs are subject to capital gains tax and income tax.

If you buy an NFT with cryptocurrency, you will incur capital gains or losses. In this case, you are ‘disposing’ of the coins you use to purchase the NFT and you will be taxed accordingly. However, buying an NFT with fiat currency like AUD is not considered a taxable event.

If you have sold an NFT that you have minted, the proceeds of the sale will be considered ordinary income. Any revenue you receive from secondary sales will also be considered ordinary income.

Decentralized finance is a rapidly evolving space, and the ATO is yet to release specific guidelines for interacting with these protocols.

Still, it’s likely that transactions on DeFi protocols will follow the same rules as other taxable cryptocurrency events. That means we can reasonably assume the following:

Forks can be taxed differently in different scenarios. If the cryptocurrency you earn post-fork has the same rights and relationships as the cryptocurrency you held pre-fork, it is considered a continuation of the original asset and does not trigger a capital gains tax event.

Pro Tip: For this reason, tax experts do not believe that the Ethereum Merge will be considered a taxable event.

On the other hand, if you receive a new cryptocurrency with new rights and relationships as a result of the fork, each one of these will be considered new tokens with a cost base of 0. Thus, you will not incur tax when the fork occurs. However, you will need to pay capital gains tax when you dispose of your new tokens.

Cryptocurrency earned through airdrops is considered ordinary income based on its fair market value at the time of receipt. If you dispose of your airdrop rewards in the future, you’ll incur a capital gain or loss depending on how the price of your crypto changed since you originally received it.

Many popular crypto applications offer referral bonuses for new users. These bonuses are considered ordinary income based on the fair market value of the coins at the time of receipt and are taxed accordingly.

Gas fees and transaction fees can be added to your cost base and can reduce your total capital gain in a disposal event.

Donating cryptocurrency is not considered a taxable event. Additionally, you will be able to deduct the value of your cryptocurrency based on its fair market value in Australian dollars at the time of the donation.

If you’ve lost cryptocurrency assets as a result of a hack or a theft in the past tax year, you may be able to claim a capital loss and reduce your total tax liability. Of course, the ATO requires proof that your cryptocurrency has really been lost and cannot be replaced. Here’s the evidence they require, as stated directly on the ATO’s website:

Did you send or receive a cryptocurrency gift sometime this year? Let’s break down how gifts are taxed for both gift givers and recipients.

In Australia, gifting cryptocurrency is considered a taxable event. You will incur a capital gain or loss based on how the price of your coins has changed since you originally received them.

Receiving cryptocurrency as a gift is not considered a taxable event. You will only need to pay taxes once you dispose of the cryptocurrency you were gifted.

If you receive a crypto gift, you should keep track of the fair market value of your gift at the time of receipt so you can easily calculate your capital gains/losses upon disposal.

There is likely no taxable activity when you borrow cryptocurrency or make a repayment on a loan. You will, however, incur capital gains or losses when you dispose of any borrowed crypto assets.

The Australian tax code does have an exemption for items bought for personal use. If you buy less than $10,000 worth of cryptocurrency for the specific purpose of buying items for personal use or consumption, you may be eligible for this exemption.

Of course, most cryptocurrency purchases are not subject to the personal asset use exemption. According to the ATO, the personal asset use exemption cannot be claimed if the purchase was originally made for investment purposes.

Remember, the longer you hold your cryptocurrency, the less likely it is to fall under this exemption category.

It’s important to be cautious when claiming this exemption. In the case of an ATO investigation, the burden of proof is on you to prove that you purchased the cryptocurrency for personal use.

If you own a business that accepts cryptocurrency for payment, you will need to keep track of the fair market value of your crypto at the time you receive it. You will then report this as part of your business income.

If you’re running a business that involves trading or mining cryptocurrency, you can write off related expenses. This might include the cost of electricity and necessary software and hardware.

To claim this deduction, you will need an Australian Business Number (ABN). That means you will fall into the trader category and will not be eligible for the long-term capital gains discount available to investors.

Individual investors cannot write off expenses.

Platforms like Binance allow investors to trade cryptocurrency on margin — in other words, borrow funds to trade crypto. It’s likely that gains from cryptocurrency margin trading will be taxed as capital gains for investors and income for traders.

With crypto futures, you can speculate on whether the price of a cryptocurrency will rise or fall in the future.

At this time, the ATO has not given guidance on how crypto futures are taxed in Australia. It’s likely that gains from crypto futures will be taxed as capital gains for investors and income for traders.

Holding your cryptocurrency in an SMSF can be a great strategy to save money on taxes! If you hold cryptocurrency in a self-managed super fund (SMSF), your gains are taxed at the concessional rate of 15%.

In most countries, crypto-assets are subject to similar tax rules as Australia.

Typically, disposals are subject to capital gains tax, while income is subject to ordinary income tax. If you’re interested in learning more, check out our international guides to crypto taxation!

How to report your capital gains and income on your tax return.

The ATO has the following guidelines in place for keeping track of your taxes. It’s recommended that you keep records of crypto transactions for at least 5 years after you prepared/acquired your records or 5 years after you completed your transactions (whichever comes later).

The ATO recommends several best practices — such as exporting your transaction history every three months and using crypto tax software.

Once you’ve collected the relevant information, you have three different options for lodging your crypto taxes

You can test out CoinLedger and import all of your cryptocurrency transaction history completely for free here. No personal information or credit card required! You only need to pay when you want to download your forms.

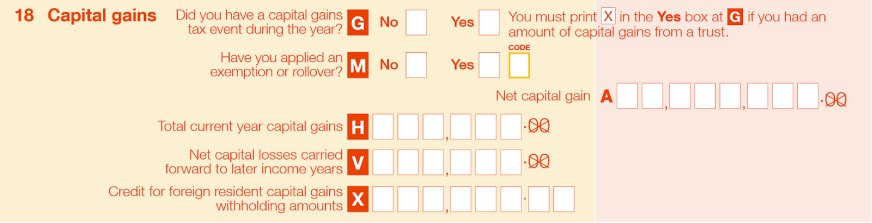

Once you have calculated your gain/loss from each transaction, add up all of your gains and losses to arrive at your net capital gain or loss for the full tax year. Report this net capital gain under section 18 of the Australian tax forms.

Cryptocurrency income should be reported on Question 2 of the Australian tax forms. On this form, you report earnings that were not salary or wages subject to standard withholdings such as tips and other income.

In the case of a sudden market downturn, some investors find themselves in the unfortunate situation of not being able to afford the taxes on their capital gains and income.

If you find yourself in this situation, you can still pay your taxes while staying compliant with Australian tax law. Individuals and businesses that owe less than $100,000 in taxes can set up a payment plan with the ATO and pay off their tax bill in installments.

Here’s how CoinLedger can help you generate a complete crypto tax report!

Step 1: Connect your CoinLedger account to your exchanges and wallets.

.png)

Step 2: Watch the platform calculate your gains, losses, and income!

.png)

Step 3: Click the View Report button to download your gains, losses, and income tax reports in AUD.

.png)

Looking for an easy way to lodge your taxes? Try CoinLedger, the crypto tax software for Australia trusted by thousands of investors.

You can use the software to import your historical cryptocurrency transactions and get a preview of your capital gain and losses from the year completely for free. You’ll only need to pay when you want to download your tax reports.

Let’s cap things off by answering some frequently asked questions about cryptocurrency taxes.

Cryptocurrency is subject to capital gains tax and ordinary income tax in Australia.

Cryptocurrency income and capital gains on any platform is subject to tax in Australia. In addition, Binance reports taxes to the ATO.

There is no way to legally evade paying taxes on your cryptocurrency. However, strategies like tax-loss selling can help you legally minimize your tax bill.

How much tax you pay on cryptocurrency is dependent on several factors such as your income bracket, whether you are classified as an investor or a trader, and the market value of the crypto you’ve disposed of in the past tax year.

If the ATO believes that a taxpayer has committed tax fraud or tax evasion, there is no time limit for conducting an audit.

There are some situations where you need to pay taxes on your cryptocurrency even if you do not “cash out” to a fiat currency. Crypto-to-crypto transactions and earning crypto income both fall into this category.

While investors can use FIFO, LIFO, or HIFO to calculate cryptocurrency taxes, traders can only use FIFO.

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out.